The Unscalable Core: Why True Judgment is the Ultimate Asset

In the world of investment, we are obsessed with scalable models and proprietary algorithms. We hunt for the "secret formula"—the quantifiable edge that can be replicated for consistent returns. But in this relentless pursuit of the scalable, we risk overlooking the most powerful asset of all: individual judgment.

This is the ultimate skill. In a world drowning in data, the ability to weigh disparate information, see the hidden connections, and make a sound decision under uncertainty is what truly separates the master from the apprentice. This isn't about being a deep expert in a single domain; it's about building a broad base of knowledge and the intellectual humility to use it wisely.

So, how is this rare and valuable quality built, and how do the best organizations attempt to harness it at scale?

Part 1: The Latticework of the Mind — How Personal Judgment is Forged

Superior judgment is not a gift; it is forged in the fires of a specific kind of intellectual discipline. It’s less like being a specialist with a microscope and more like being a cartographer, mapping the entire landscape. This process has two essential components:

- Building a Broad Latticework: The famous investor Charlie Munger advocates for building a "latticework of mental models" in your head. The idea is simple: you cannot understand a complex system through a single lens. If your only tool is finance, every problem looks like a spreadsheet. But if you can pull from psychology, history, biology, and physics, you can analyze a situation from multiple angles. You start asking better questions: Is this business model evolving like a robust ecosystem? Is the market being swayed by herd mentality? Has this pattern of disruption appeared before in history? The answers to these questions provide a richness that a single-domain expert can never access.

- A Brutally Honest Feedback Loop: The most effective way to build judgment is to make concentrated bets where your personal reasoning is on the line. Committing significant capital to a single, high-conviction idea forces intellectual honesty. Every outcome—good or bad—is a direct referendum on your thinking. This creates a powerful feedback loop. The pain of being wrong forces a rigorous post-mortem: "Where did my reasoning fail?" This process of self-interrogation and learning is what turns raw knowledge into true, applicable wisdom. It teaches patience, temperament, and the crucial skill of knowing the difference between a bad process and a bad outcome.

This is a stark contrast to a diversified, "spray and pray" approach. When you make dozens of small bets, the feedback loop is long, noisy, and deceptive. It becomes nearly impossible to distinguish skill from luck, and the incentive to learn from any single failure is low. The concentrated path is a judgment accelerator; the diversified path can be a trap of reinforcing the wrong lessons.

Part 2: The Architect of Judgment — Scaling the Unscalable

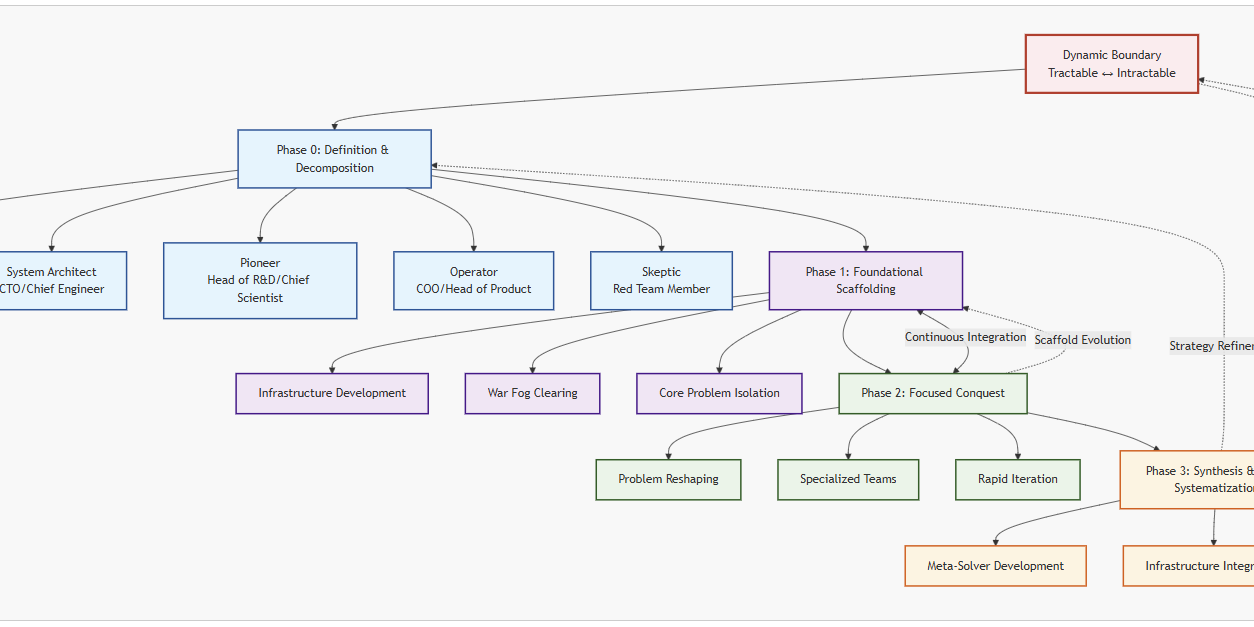

If individual judgment is so personal and hard-won, how do the best organizations—like a top-tier venture capital firm—leverage it across a team? They don't try to clone their star performers or codify their wisdom into a rigid manual. Instead, they play a meta-game, building a system designed to harness and amplify the power of individual expertise. This is the "Federated Expert Model."

The leader of such a firm becomes an Architect of Judgment. Their primary job shifts from analyzing companies to analyzing people and systems.

- They Invest in Investors: Their most critical investment is in hiring partners with world-class, independent judgment in complementary fields (e.g., one expert in biotech, another in enterprise SaaS). The leader knows they cannot be an expert in everything, so they underwrite the judgment of specialists they trust. Their core question changes from, "Is this a good investment?" to "Is this a person whose judgment I can trust to make great investments?"

- They Architect the Portfolio: The leader's role is to construct a winning portfolio from the "best ideas" of their partners. They manage position sizing, risk concentration, and capital reserves. They must be the dispassionate voice that asks, "Even if this is a great company, is it the right fit for our fund's strategy right now?" This is a fund-level judgment that transcends the conviction of any single partner.

- They Build the Arena of Judgment: Most importantly, the leader designs the culture. They create an environment—most notably, the investment committee meeting—where ideas are fiercely debated, assumptions are challenged, and theses are stress-tested. The firm's collective judgment emerges not from consensus, but from the controlled collision of these brilliant, independent minds.

This isn't true "scaling." It's leverage. The leader isn't replicating their own judgment; they are building a structure around the unscalable judgment of a select few.

Conclusion: The Enduring Value of the Unscalable Core

In the end, we must confront a fundamental truth: judgment cannot be truly scaled. You cannot franchise wisdom. You cannot automate insight. You can build larger teams, more sophisticated processes, and better systems for collaboration, but at the very center of any great, judgment-based enterprise lies an unscalable core of individual human wisdom.

The best a leader can do is not to replicate this core, but to build the best possible structure around it—a structure that protects it, leverages it, and allows it to have the greatest possible impact.

In an age rushing toward automation and algorithmic solutions, this is a powerful reminder of our own value. The ability to think broadly, learn from our mistakes, and synthesize complex information into a clear and decisive conclusion is not just a skill. It is the very essence of human contribution. It is the unscalable core that will always be our most precious asset.